Q2 FINANCIAL RESULTS & BUSINESS UPDATE WEDNESDAY, AUGUST 10, 2022

Forward Looking Statements This presentation contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “believe,” “expect,” “plan,” “anticipate,” “project” and similar expressions (as well as other words or expressions referencing future events or circumstances)

are intended to identify forward-looking statements. All statements other than statements of historical facts included in this presentation are forward-looking statements. These statements include, but are not limited to, statements regarding

the marketing and therapeutic potential of KIMMTRAK for metastatic uveal melanoma (mUM); the expected clinical benefits of KIMMTRAK and Immunocore’s other product candidates, including extended overall survival benefit; expectations regarding

the commercialization of KIMMTRAK, including in the United States, Germany and France, as well other additional territories, including the potential for and timing of commercial availability of KIMMTRAK in additional countries and the ability

to reach patients in a timely manner; expectations regarding receipt of regulatory approvals the value proposition of Immunocore’s product candidates, including KIMMTRAK in mUM and its benefit as an orphan indication, including expectations

regarding the potential market size and opportunity for such product candidates; Immunocore’s sales and marketing plans, including with respect to the United States, Europe and additional territories where regulatory approval has been

obtained; the validation of the global supply chain; the magnitude of any potential revenues generated by KIMMTRAK; physician’s feedback, endorsements, guidelines and interest in prescribing KIMMTRAK as the standard of care for mUM;

Immunocore’s efforts to expand patients’ access to medicine; future development plans of tebentafusp, including the timing or likelihood of expansion into additional markets or geographies; the success of Immunocore's partnership with

Genentech and other current and future collaborations, partnerships or licensing arrangements; Immunocore's ability to support mUM patients on Early Access Program; the design, progress, timing, scope and results of Immunocore’s existing and

planned clinical trials, including the randomized Phase 2/3 clinical trial in previously treated advanced melanoma and PRAME and MAGE A4 clinical trials; the number of patients with PRAME and MAGE A4; and Immunocore’s financial projections,

including its anticipated cash runway. These forward-looking statements are based on management's current expectations and beliefs of future events and are subject to a number of risks, uncertainties and important factors that may cause

actual events or results to differ materially and adversely from those expressed or implied by any forward-looking statements, many of which are beyond Immunocore’s control. These include, without limitation, risks and uncertainties related

to the impact of the ongoing and evolving COVID-19 pandemic on Immunocore’s business, strategy and anticipated milestones, including Immunocore’s ability to conduct ongoing and planned clinical trials; Immunocore’s ability to obtain a

clinical supply of current or future product candidates or; commercial supply of KIMMTRAK or any future approved products, including as a result of the COVID-19 pandemic, war in Ukraine or global geopolitical tension; Immunocore’s ability to

obtain and maintain regulatory approval of its product candidates, including KIMMTRAK; Immunocore’s ability and plans in continuing to establish and expand a commercial infrastructure and to successfully launch, market and sell KIMMTRAK and

any future approved products; Immunocore’s ability to successfully expand the approved indications for KIMMTRAK or obtain marketing approval for KIMMTRAK in additional geographies in the future; the delay of any current or planned clinical

trials, whether due to the COVID-19 pandemic, patient enrollment delays or otherwise; Immunocore’s ability to successfully demonstrate the safety and efficacy of its product candidates and gain approval of its product candidates on a timely

basis, if at all; competition with respect to market opportunities; unexpected safety or efficacy data observed during preclinical studies or clinical trials; actions of regulatory agencies, which may affect the initiation, timing and

progress of clinical trials or future regulatory approval; Immunocore's need for and ability to obtain additional funding, on favorable terms or at all, including as a result of rising inflation, interest rates and general market conditions,

and the impacts thereon of the COVID-19 pandemic, war in Ukraine and global geopolitical tension; and Immunocore’s ability to obtain, maintain and enforce intellectual property protection for KIMMTRAK or any product candidates it is

developing. These and other risks and uncertainties are described in greater detail in the section titled "Risk Factors" in Immunocore’s filings with the Securities and Exchange Commission (SEC), including Immunocore’s most recent Annual

Report on Form 20-F, as supplemented by its most recent filings that Immunocore has made or may make with the SEC in the future. Such risks may be amplified by the COVID-19 pandemic, war in Ukraine and related geopolitical tension, and

their potential impacts on Immunocore’s business and the overall global economy. All forward-looking statements contained in this presentation speak only as of the date on which they were made and should not be relied upon as representing its

views as of any subsequent date. Except to the extent required by law, Immunocore undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made. This

presentation contains non-IFRS financial measures, including Adjusted Cash and Cash Equivalents, which have certain limitations and should not be considered in isolation, or as alternatives or substitutes for, financial measures determined in

accordance with IFRS. Certain information contained in this presentation relates to or is based on studies, publications, surveys, and other data obtained from third-party sources and Immunocore’s own internal estimates and research. While

Immunocore believes these third-party sources to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy, or completeness of, any information

obtained from third-party sources. KIMMTRAK™ is a trademark owned or licensed to Immunocore.

Overview & Q2 Highlights Bahija Jallal, PhD – Chief Executive Officer Q2 Financials Brian Di

Donato – Chief Financial Officer & Head of Strategy KIMMTRAK® LaunchRalph Torbay – Head of Commercial Portfolio UpdateDavid Berman, MD, PhD – Head of R&D Concluding Remarks Bahija Jallal, PhD – Chief Executive Officer Q&A

Session

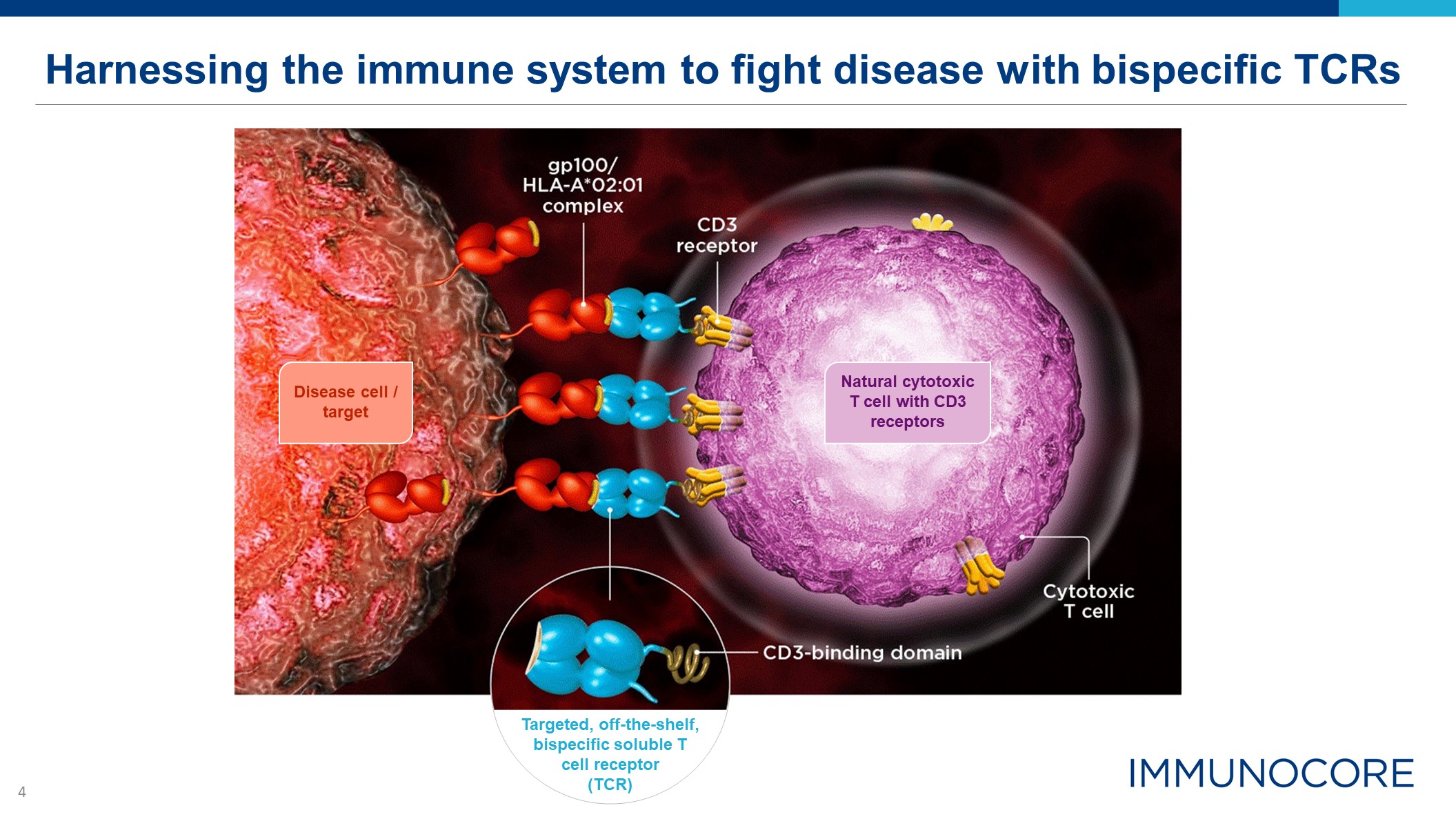

Harnessing the immune system to fight disease with bispecific TCRs Disease cell / target Targeted,

off-the-shelf, bispecific soluble T cell receptor (TCR) Natural cytotoxic T cell with CD3 receptors

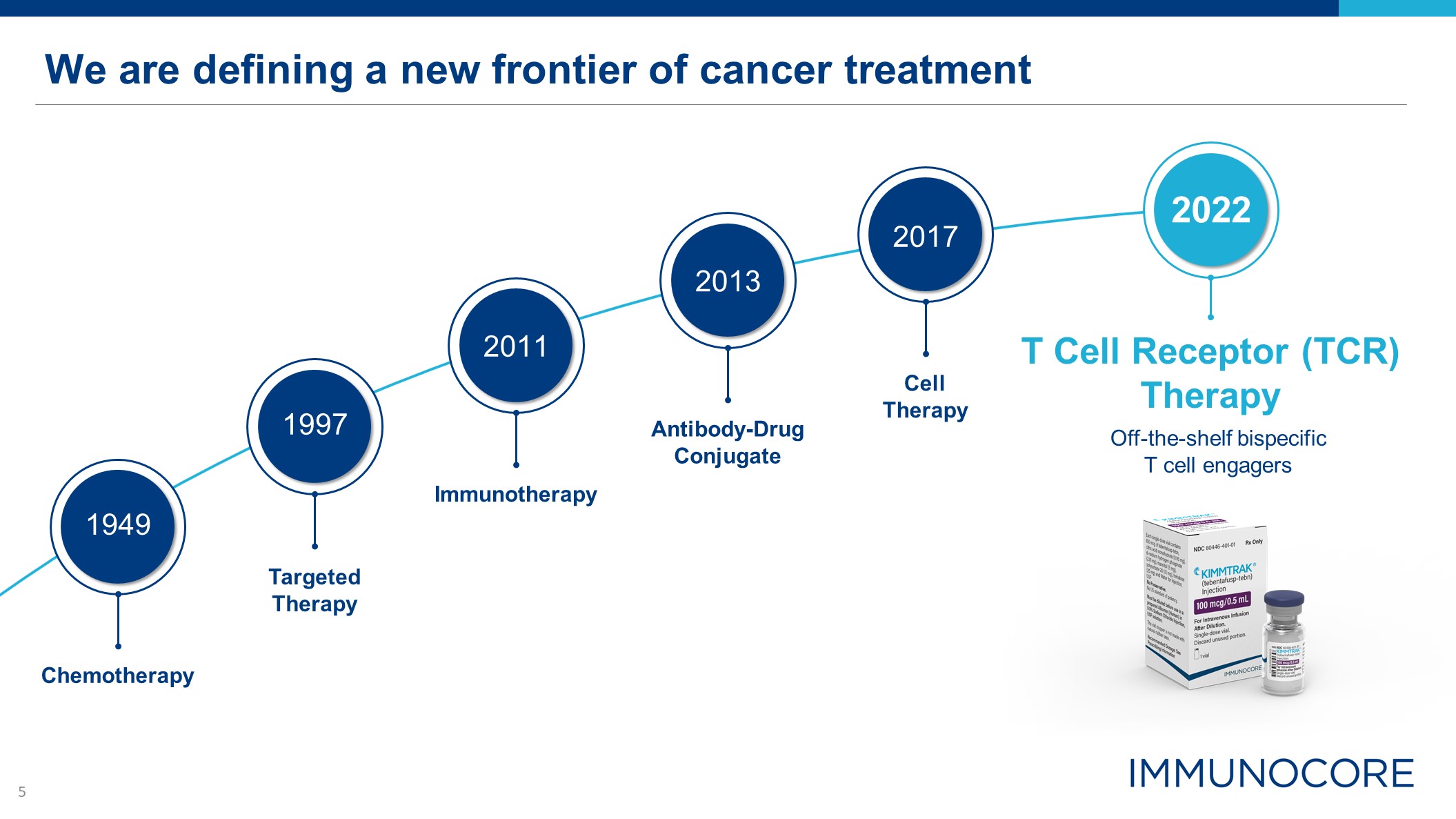

We are defining a new frontier of cancer treatment T Cell Receptor (TCR) Therapy Off-the-shelf

bispecific T cell engagers Chemotherapy 1949 Targeted Therapy 1997 Immunotherapy 2011 Antibody-DrugConjugate 2013 Cell Therapy 2017 2022

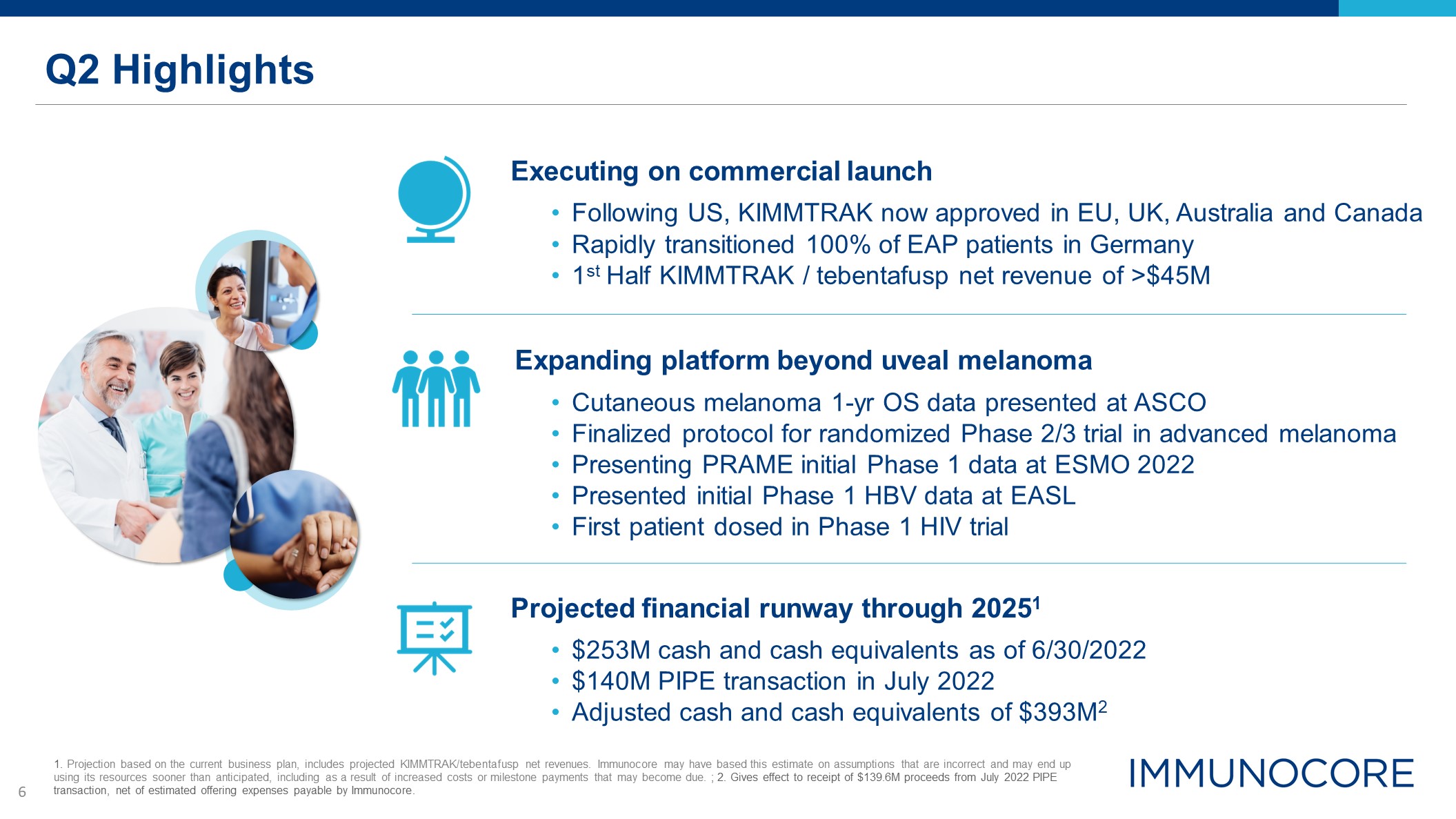

Q2 Highlights Executing on commercial launch Following US, KIMMTRAK now approved in EU, UK, Australia

and Canada Rapidly transitioned 100% of EAP patients in Germany 1st Half KIMMTRAK / tebentafusp net revenue of >$45M Expanding platform beyond uveal melanoma Cutaneous melanoma 1-yr OS data presented at ASCO Finalized protocol for

randomized Phase 2/3 trial in advanced melanoma Presenting PRAME initial Phase 1 data at ESMO 2022 Presented initial Phase 1 HBV data at EASL First patient dosed in Phase 1 HIV trial Projected financial runway through 20251 $253M cash

and cash equivalents as of 6/30/2022 $140M PIPE transaction in July 2022 Adjusted cash and cash equivalents of $393M2 1. Projection based on the current business plan, includes projected KIMMTRAK/tebentafusp net revenues. Immunocore may

have based this estimate on assumptions that are incorrect and may end up using its resources sooner than anticipated, including as a result of increased costs or milestone payments that may become due. ; 2. Gives effect to receipt of $139.6M

proceeds from July 2022 PIPE transaction, net of estimated offering expenses payable by Immunocore.

Q2 Financials BRIAN DI DONATO CFO & Head of Strategy

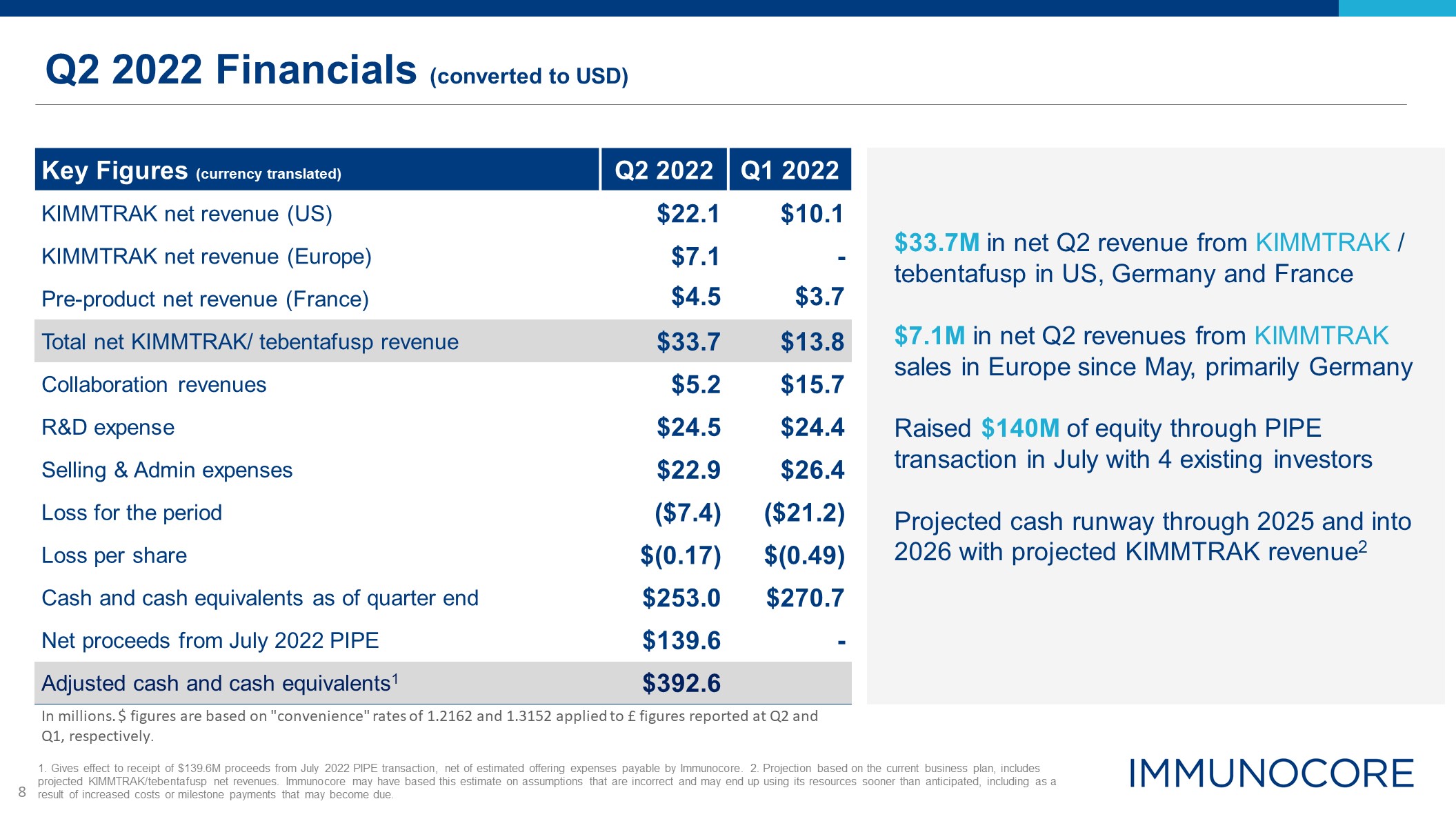

Q2 2022 Financials (converted to USD) Key Figures (currency translated) Q2 2022 Q1 2022 KIMMTRAK

net revenue (US) $22.1 $10.1 KIMMTRAK net revenue (Europe) $7.1 - Pre-product net revenue (France) $4.5 $3.7 Total net KIMMTRAK/ tebentafusp revenue $33.7 $13.8 Collaboration revenues $5.2 $15.7 R&D

expense $24.5 $24.4 Selling & Admin expenses $22.9 $26.4 Loss for the period ($7.4) ($21.2) Loss per share $(0.17) $(0.49) Cash and cash equivalents as of quarter end $253.0 $270.7 Net proceeds from July 2022

PIPE $139.6 - Adjusted cash and cash equivalents1 $392.6 $33.7M in net Q2 revenue from KIMMTRAK / tebentafusp in US, Germany and France $7.1M in net Q2 revenues from KIMMTRAK sales in Europe since May, primarily Germany Raised $140M

of equity through PIPE transaction in July with 4 existing investors Projected cash runway through 2025 and into 2026 with projected KIMMTRAK revenue2 1. Gives effect to receipt of $139.6M proceeds from July 2022 PIPE transaction, net of

estimated offering expenses payable by Immunocore. 2. Projection based on the current business plan, includes projected KIMMTRAK/tebentafusp net revenues. Immunocore may have based this estimate on assumptions that are incorrect and may end

up using its resources sooner than anticipated, including as a result of increased costs or milestone payments that may become due. In millions. $ figures are based on "convenience" rates of 1.2162 and 1.3152 applied to £ figures reported

at Q2 and Q1, respectively.

KIMMTRAK® Launch RALPH TORBAY Head of Commercial

All US (Q1) and Germany (Q2) EAP patients transitioned to commercial supply Inclusion in NCCN &

ASCO1 guidelines Approvals in 30+ countries including recent approvals in UK, Australia, and Canada $46.5M in KIMMTRAK/ tebentafusp net revenue 1H 2022 1. National Comprehensive Cancer Network (NCCN) & American Society of Clinical

Oncology (ASCO) Executing on the global commercial launch of KIMMTRAK

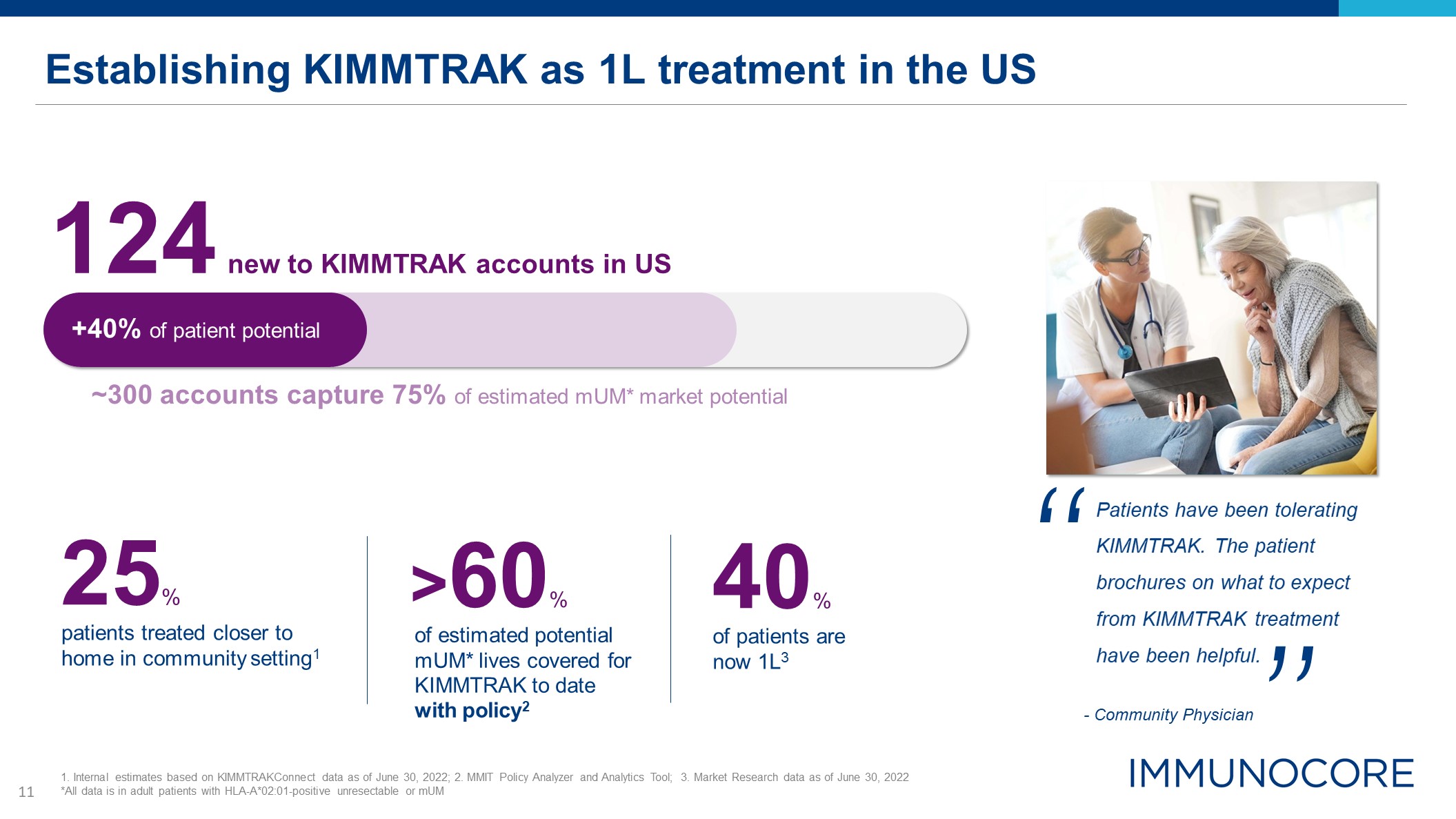

Establishing KIMMTRAK as 1L treatment in the US ~300 accounts capture 75% of estimated mUM* market

potential 124 new to KIMMTRAK accounts in US patients treated closer to home in community setting1 25% of patients are now 1L3 40% +40% of patient potential 1. Internal estimates based on KIMMTRAKConnect data as of June 30, 2022; 2.

MMIT Policy Analyzer and Analytics Tool; 3. Market Research data as of June 30, 2022 *All data is in adult patients with HLA-A*02:01-positive unresectable or mUM Patients have been tolerating KIMMTRAK. The patient brochures on what to

expect from KIMMTRAK treatment have been helpful. “ ” - Community Physician of estimated potential mUM* lives covered for KIMMTRAK to date with policy2 >60%

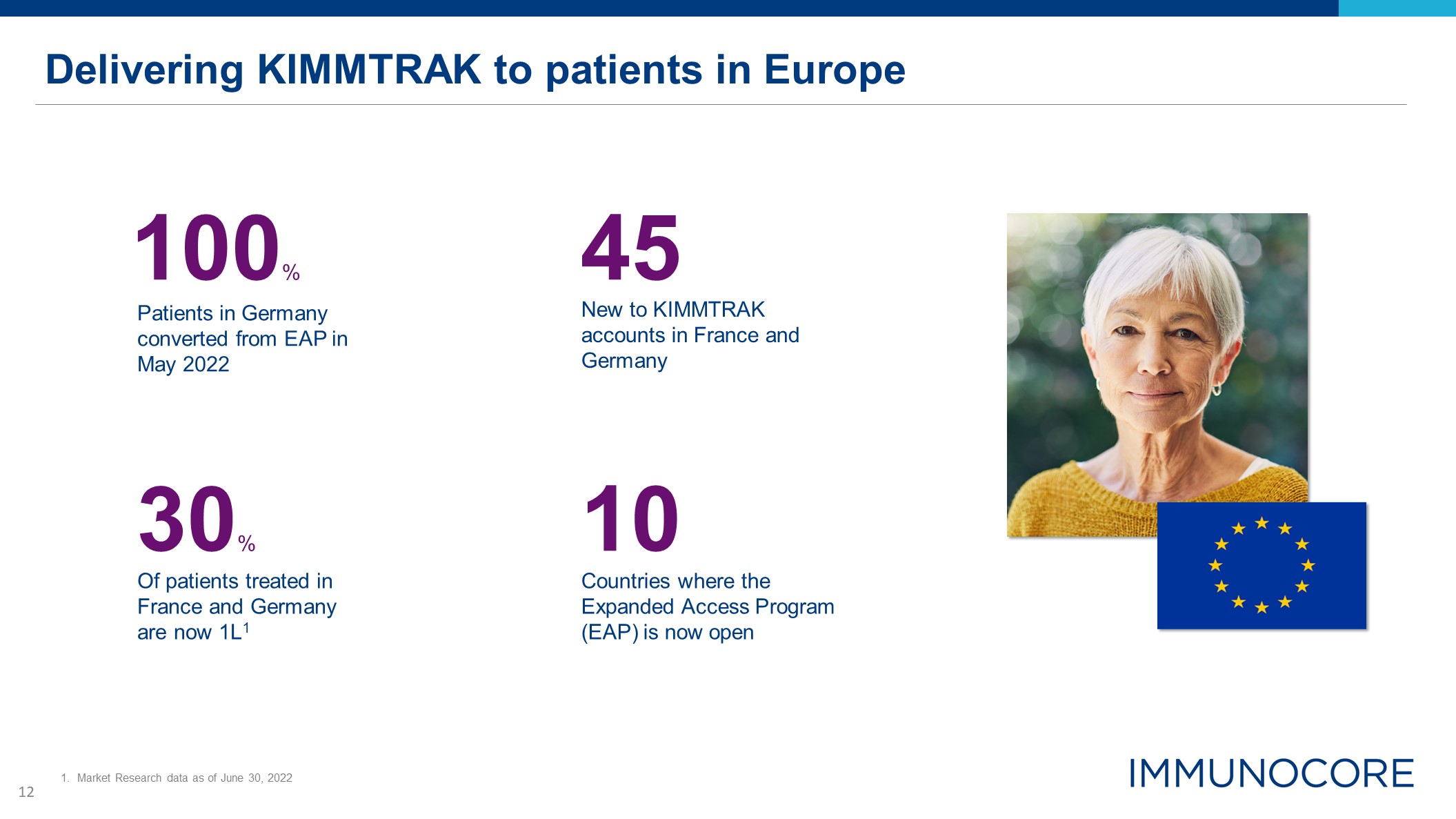

Delivering KIMMTRAK to patients in Europe Patients in Germany converted from EAP in May 2022 100% Of

patients treated in France and Germany are now 1L1 30% Countries where the Expanded Access Program (EAP) is now open 10 New to KIMMTRAK accounts in France and Germany 45 Market Research data as of June 30, 2022

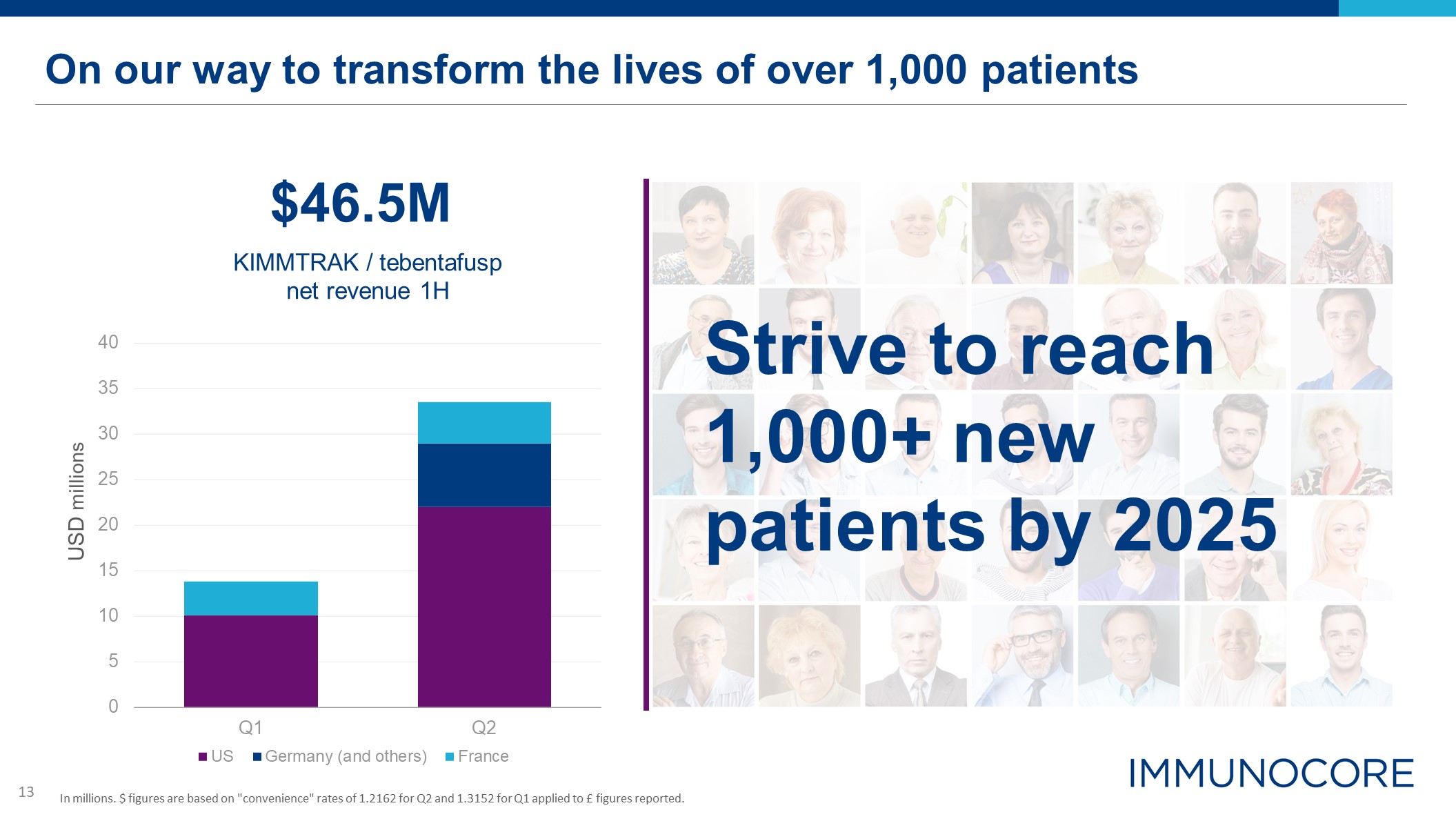

On our way to transform the lives of over 1,000 patients USD millions $46.5M KIMMTRAK / tebentafusp

net revenue 1H Strive to reach 1,000+ new patients by 2025 In millions. $ figures are based on "convenience" rates of 1.2162 for Q2 and 1.3152 for Q1 applied to £ figures reported.

Portfolio Update DAVID BERMAN Head of Research and Development

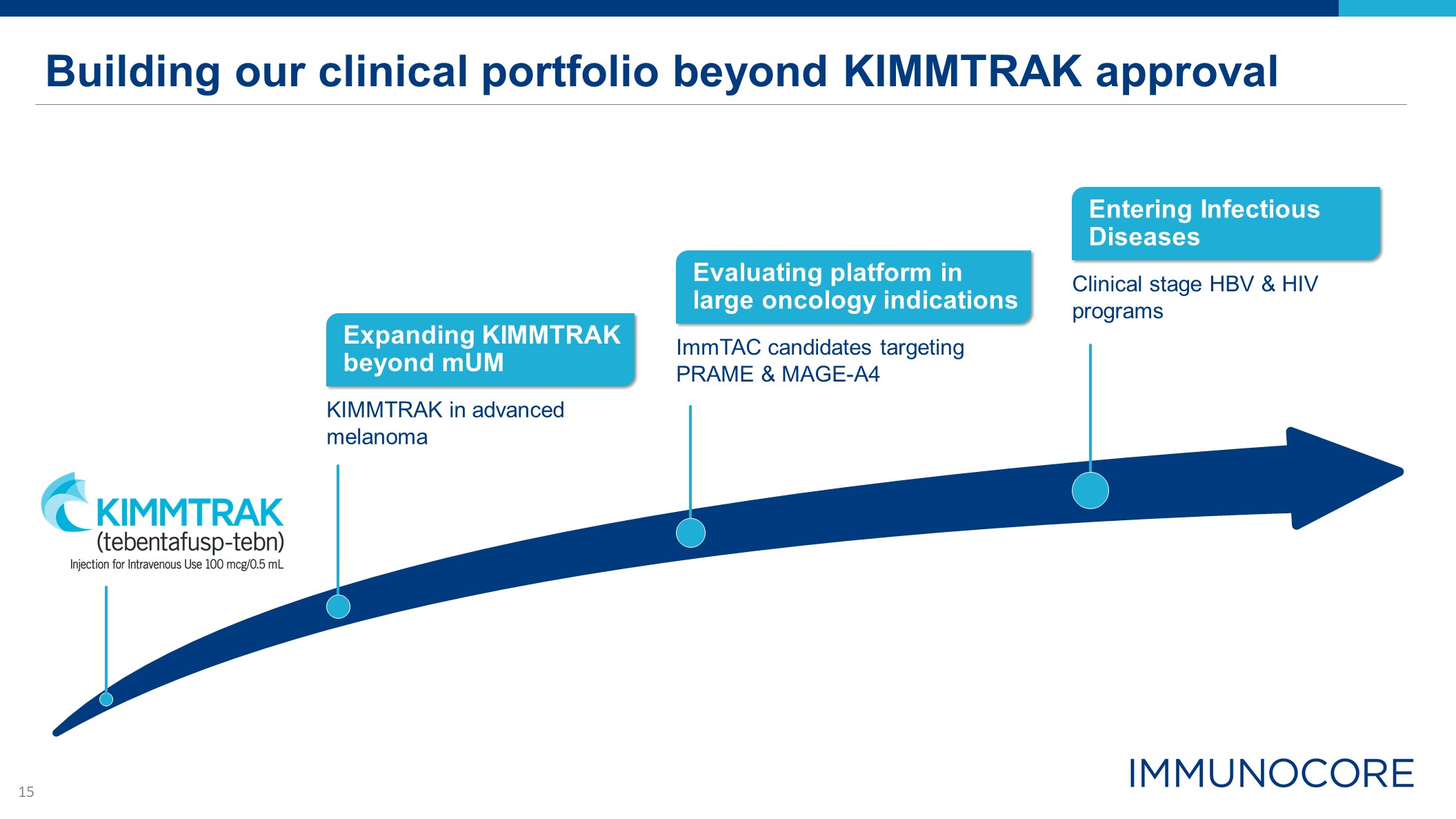

Building our clinical portfolio beyond KIMMTRAK approval Expanding KIMMTRAK beyond mUM KIMMTRAK in

advanced melanoma Clinical stage HBV & HIV programs Entering Infectious Diseases ImmTAC candidates targeting PRAME & MAGE-A4 Evaluating platform in large oncology indications

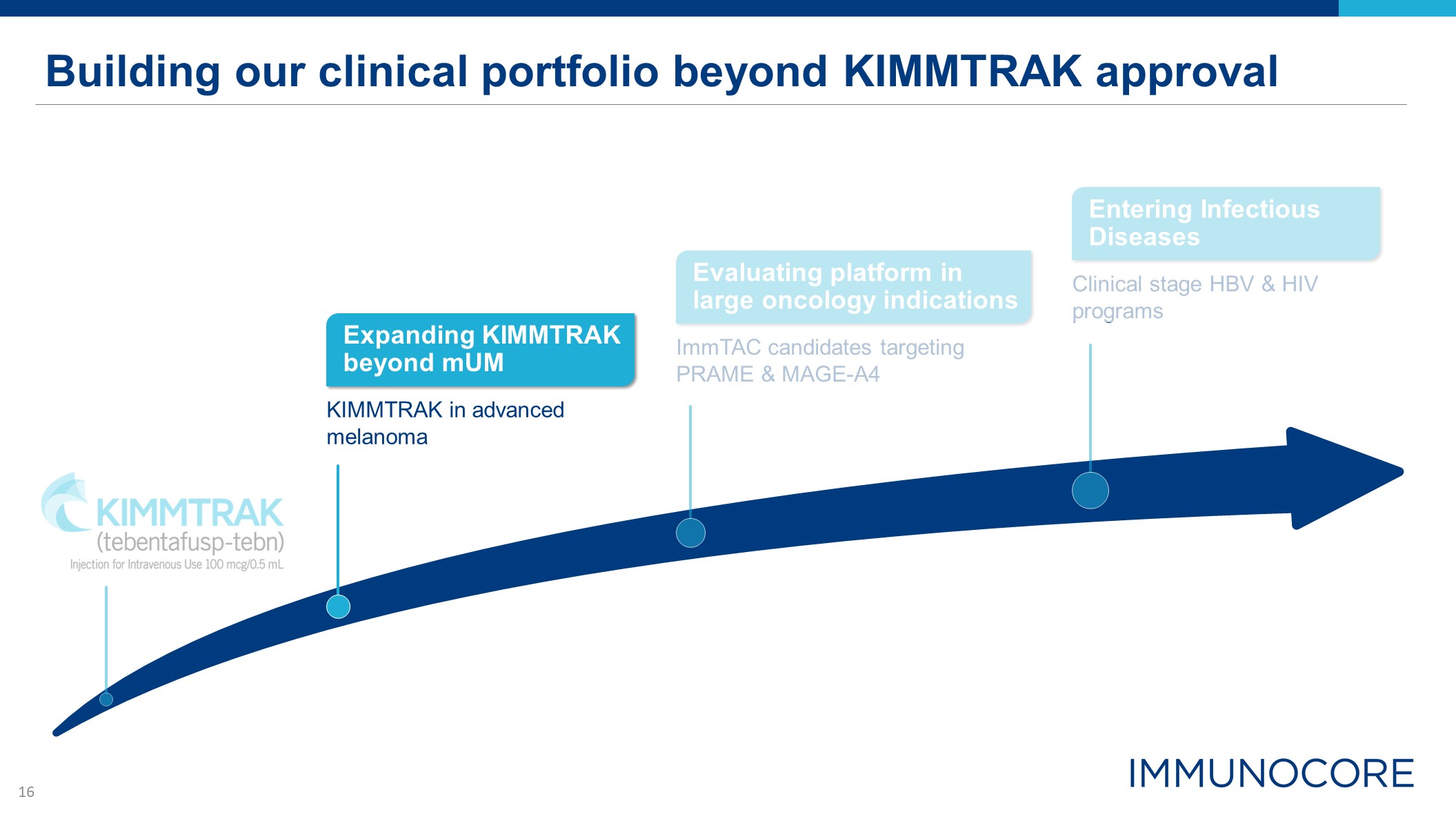

Building our clinical portfolio beyond KIMMTRAK approval Expanding KIMMTRAK beyond mUM KIMMTRAK in

advanced melanoma Clinical stage HBV & HIV programs Entering Infectious Diseases ImmTAC candidates targeting PRAME & MAGE-A4 Evaluating platform in large oncology indications

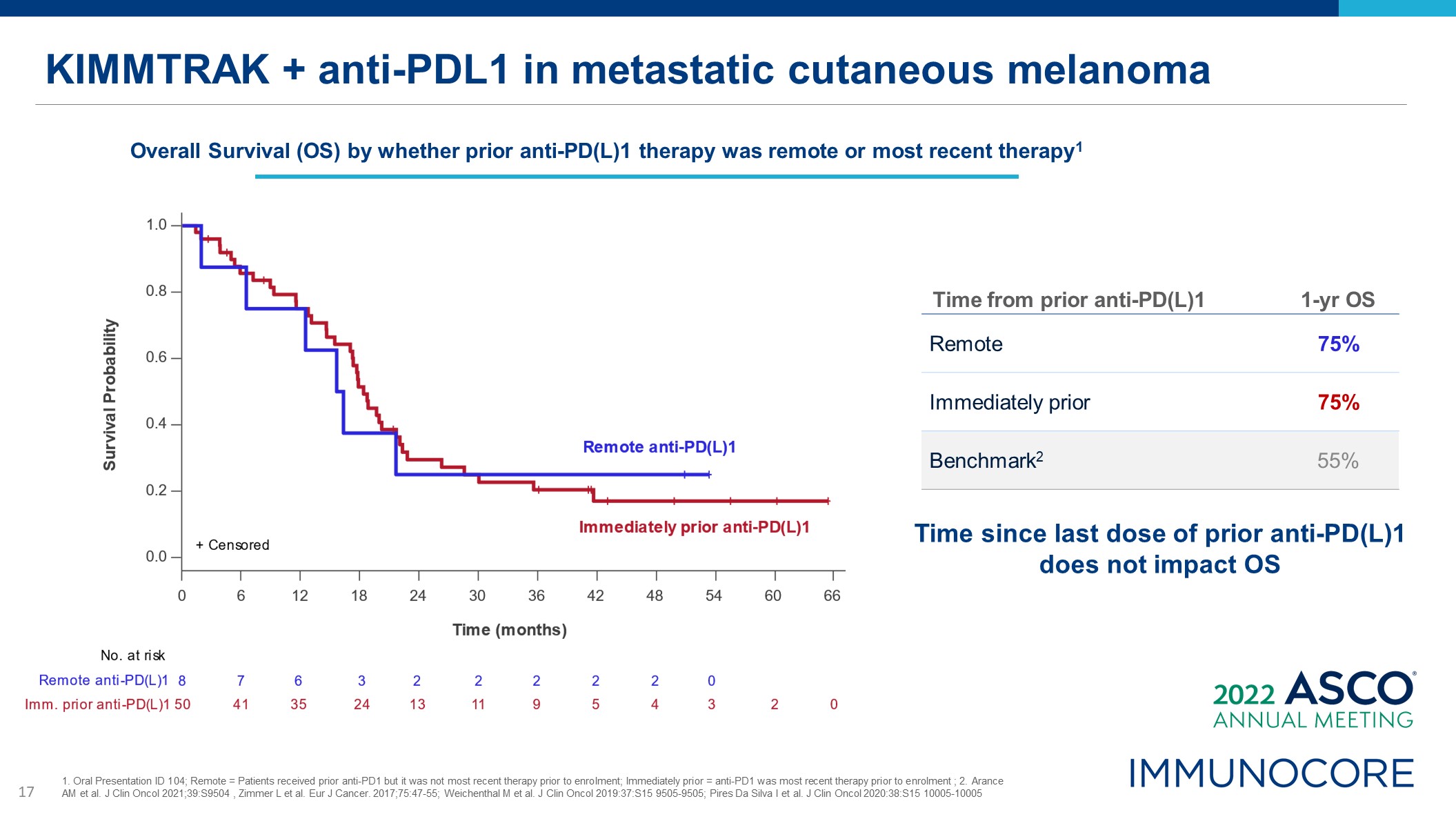

KIMMTRAK + anti-PDL1 in metastatic cutaneous melanoma Time from prior anti-PD(L)1 1-yr

OS Remote 75% Immediately prior 75% Benchmark2 55% Time since last dose of prior anti-PD(L)1 does not impact OS Overall Survival (OS) by whether prior anti-PD(L)1 therapy was remote or most recent therapy1 1. Oral Presentation ID

104; Remote = Patients received prior anti-PD1 but it was not most recent therapy prior to enrolment; Immediately prior = anti-PD1 was most recent therapy prior to enrolment ; 2. Arance AM et al. J Clin Oncol 2021;39:S9504 , Zimmer L et al.

Eur J Cancer. 2017;75:47-55; Weichenthal M et al. J Clin Oncol 2019:37:S15 9505-9505; Pires Da Silva I et al. J Clin Oncol 2020:38:S15 10005-10005

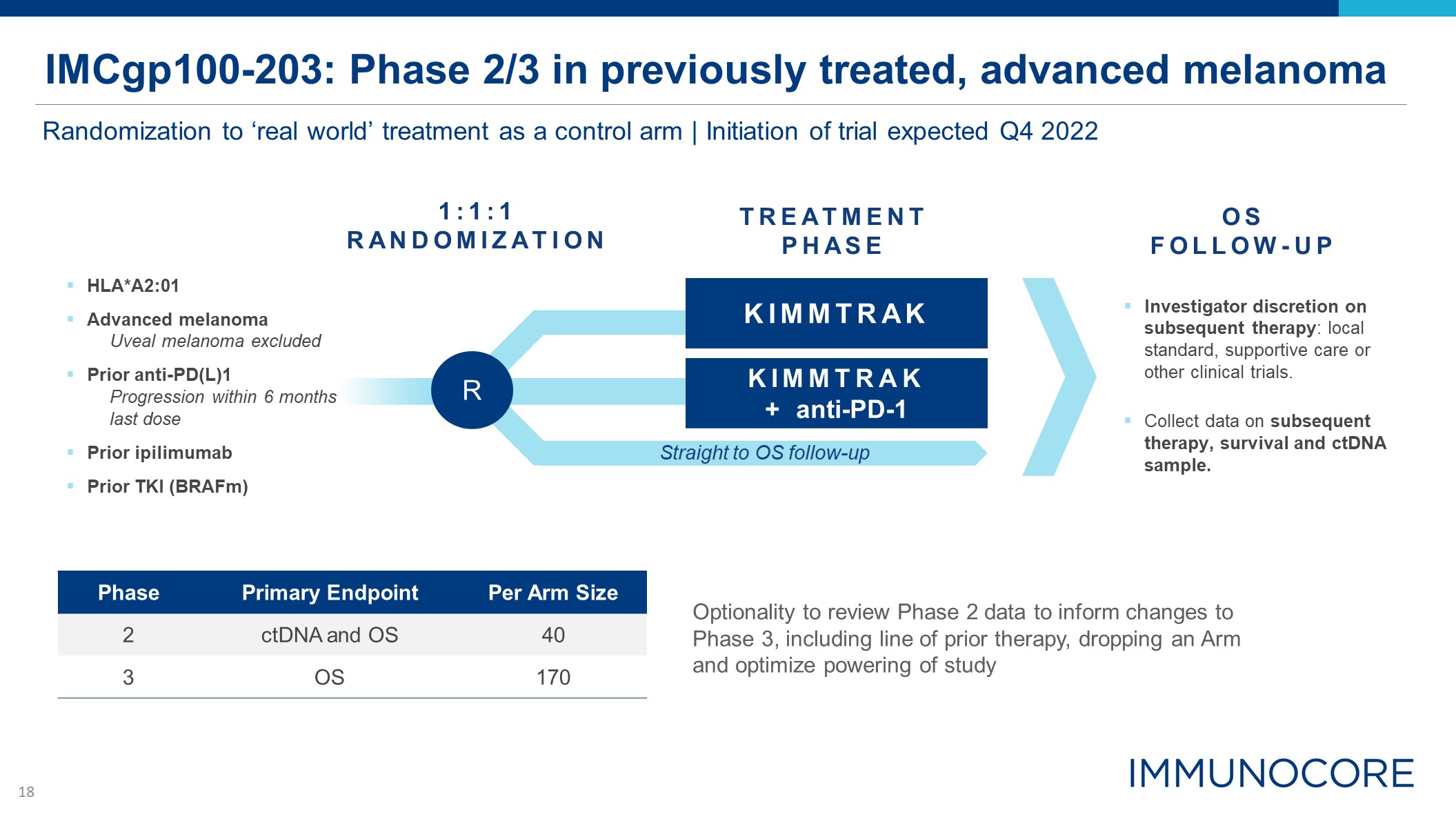

IMCgp100-203: Phase 2/3 in previously treated, advanced melanoma Randomization to ‘real world’

treatment as a control arm | Initiation of trial expected Q4 2022 Phase Primary Endpoint Per Arm Size 2 ctDNA and OS 40 3 OS 170 KIMMTRAK KIMMTRAK + anti-PD-1 R Investigator discretion on subsequent therapy: local standard,

supportive care or other clinical trials. Collect data on subsequent therapy, survival and ctDNA sample. 1:1:1 RANDOMIZATION HLA*A2:01 Advanced melanoma Uveal melanoma excluded Prior anti-PD(L)1 Progression within 6 months last dose

Prior ipilimumab Prior TKI (BRAFm) TREATMENT PHASE OS FOLLOW-UP Straight to OS follow-up Optionality to review Phase 2 data to inform changes to Phase 3, including line of prior therapy, dropping an Arm and optimize powering of study

Building our clinical portfolio beyond KIMMTRAK approval Expanding KIMMTRAK beyond mUM KIMMTRAK in

advanced melanoma Clinical stage HBV & HIV programs Entering Infectious Diseases ImmTAC candidates targeting PRAME & MAGE-A4 Evaluating platform in large oncology indications

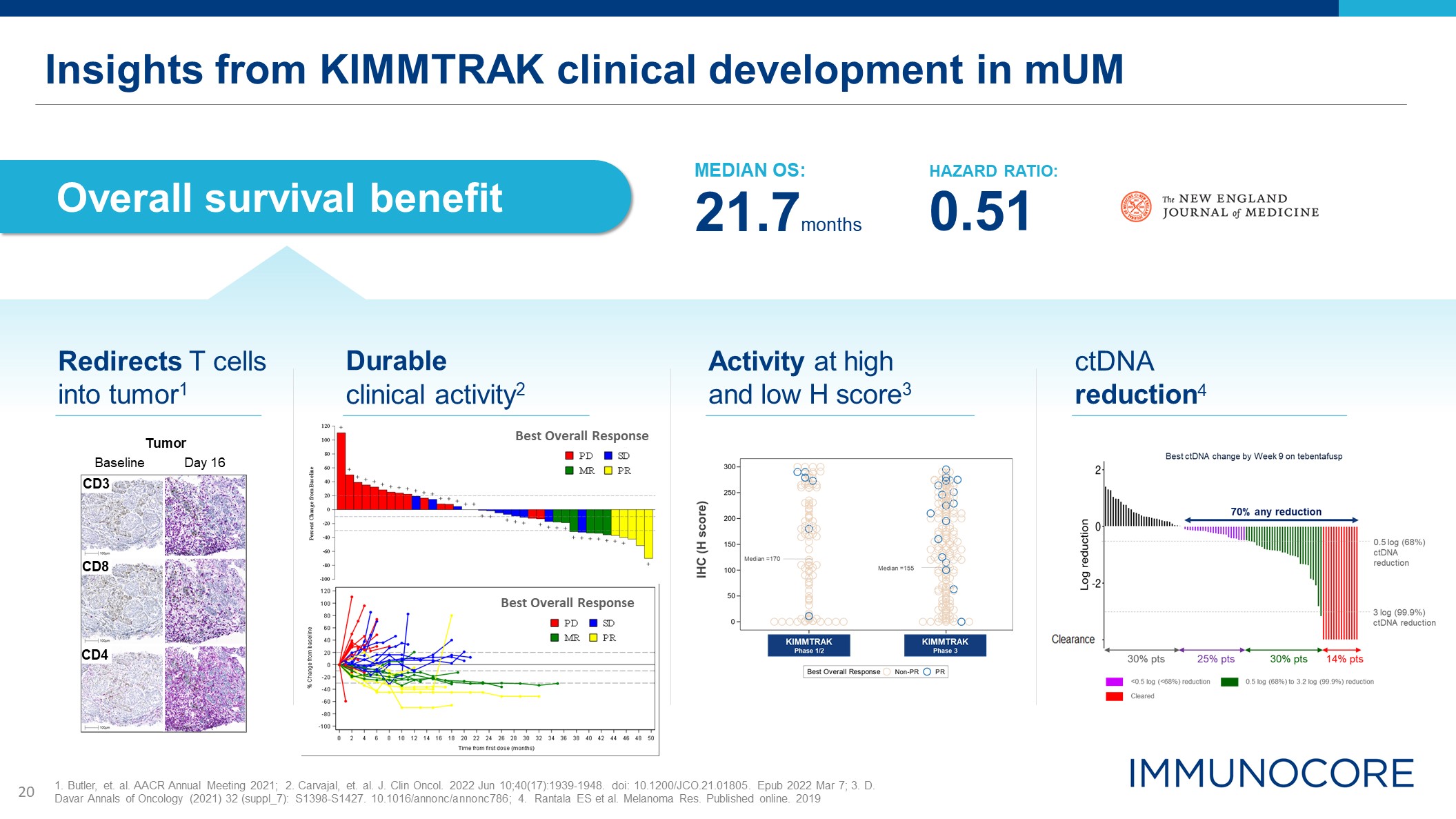

Insights from KIMMTRAK clinical development in mUM Overall survival benefit Tumor Day

16 Baseline CD8 CD4 CD3 MEDIAN OS: 21.7months HAZARD RATIO: 0.51 Redirects T cells into tumor1 Durable clinical activity2 Activity at high and low H score3 ctDNA reduction4 1. Butler, et. al. AACR Annual Meeting 2021; 2.

Carvajal, et. al. J. Clin Oncol. 2022 Jun 10;40(17):1939-1948. doi: 10.1200/JCO.21.01805. Epub 2022 Mar 7; 3. D. Davar Annals of Oncology (2021) 32 (suppl_7): S1398-S1427. 10.1016/annonc/annonc786; 4. Rantala ES et al. Melanoma Res. Published

online. 2019 Best Overall Response Best Overall Response

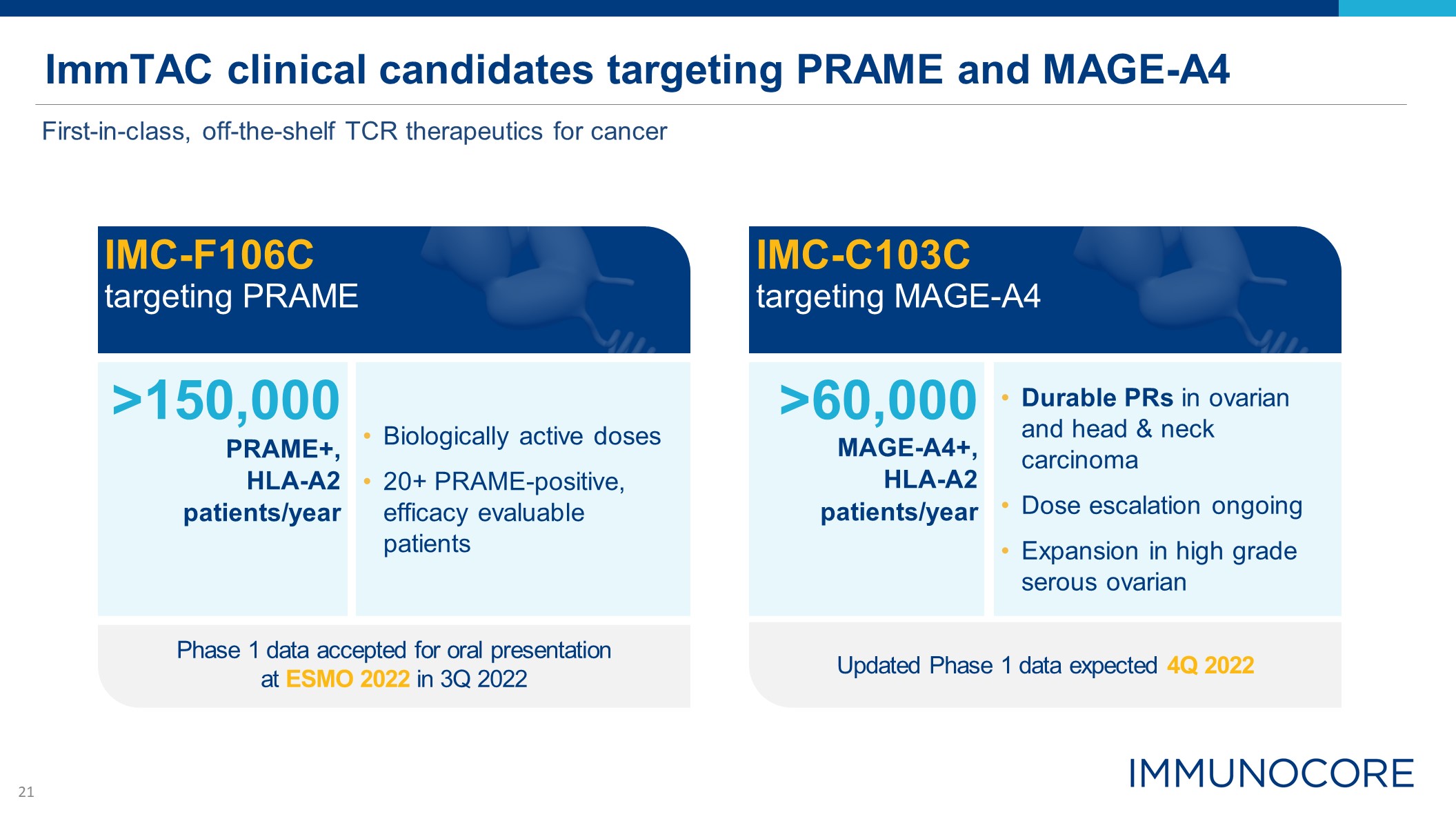

ImmTAC clinical candidates targeting PRAME and MAGE-A4 IMC-F106C targeting

PRAME >150,000 PRAME+, HLA-A2 patients/year Biologically active doses 20+ PRAME-positive, efficacy evaluable patients IMC-C103C targeting MAGE-A4 >60,000 MAGE-A4+, HLA-A2 patients/year Durable PRs in ovarian and head

& neck carcinoma Dose escalation ongoing Expansion in high grade serous ovarian Updated Phase 1 data expected 4Q 2022 First-in-class, off-the-shelf TCR therapeutics for cancer Phase 1 data accepted for oral presentation at ESMO 2022

in 3Q 2022

Building our clinical portfolio beyond KIMMTRAK approval Expanding KIMMTRAK beyond mUM KIMMTRAK in

advanced melanoma Clinical stage HBV & HIV programs Entering Infectious Diseases ImmTAC candidates targeting PRAME & MAGE-A4 Evaluating platform in large oncology indications

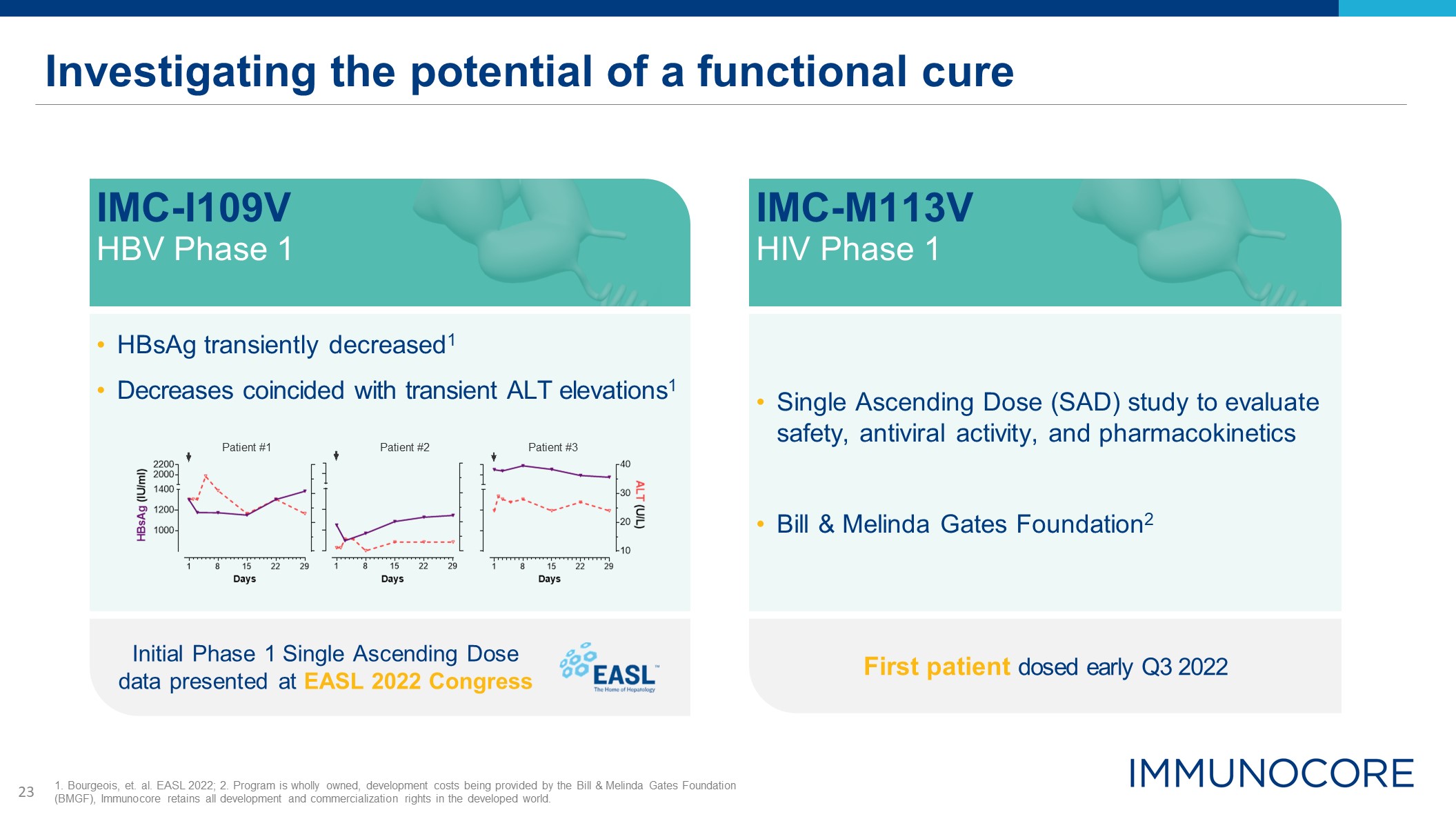

Investigating the potential of a functional cure HBsAg transiently decreased1 Decreases coincided

with transient ALT elevations1 Initial Phase 1 Single Ascending Dose data presented at EASL 2022 Congress IMC-I109V HBV Phase 1 Patient #1 Patient #2 Patient #3 1. Bourgeois, et. al. EASL 2022; 2. Program is wholly owned, development

costs being provided by the Bill & Melinda Gates Foundation (BMGF), Immunocore retains all development and commercialization rights in the developed world. Single Ascending Dose (SAD) study to evaluate safety, antiviral activity, and

pharmacokinetics Bill & Melinda Gates Foundation2 First patient dosed early Q3 2022 IMC-M113V HIV Phase 1

Concluding Remarks BAHIJA JALLAL Chief Executive Officer

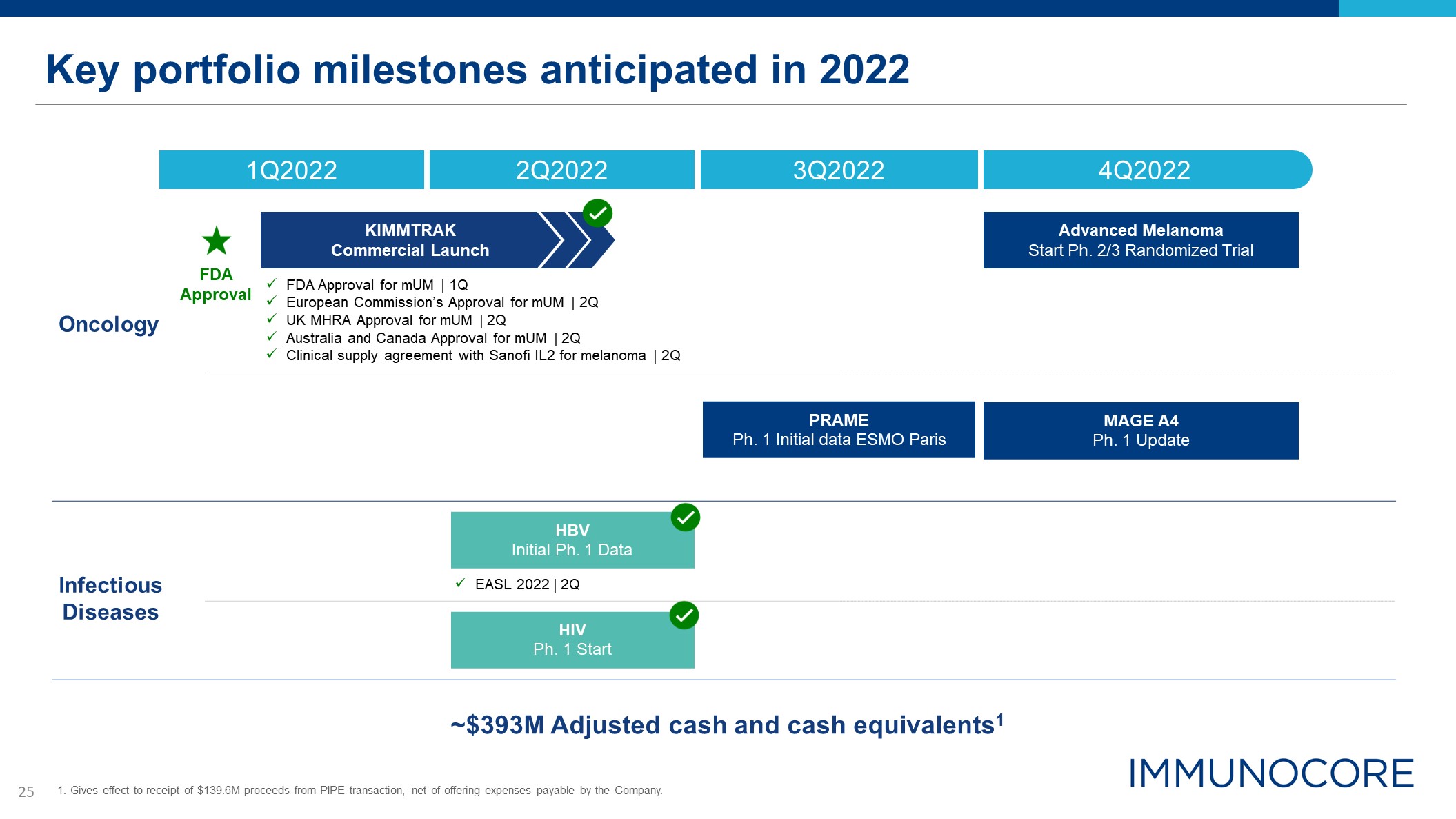

Key portfolio milestones anticipated in 2022 ~$393M Adjusted cash and cash

equivalents1 Oncology Infectious Diseases FDA Approval FDA Approval for mUM | 1Q European Commission’s Approval for mUM | 2Q UK MHRA Approval for mUM | 2Q Australia and Canada Approval for mUM | 2Q Clinical supply agreement with

Sanofi IL2 for melanoma | 2Q 4Q2022 1Q2022 2Q2022 3Q2022 HIV Ph. 1 Start PRAME Ph. 1 Initial data ESMO Paris MAGE A4 Ph. 1 Update Advanced Melanoma Start Ph. 2/3 Randomized Trial KIMMTRAK Commercial Launch HBV Initial Ph. 1

Data EASL 2022 | 2Q 1. Gives effect to receipt of $139.6M proceeds from PIPE transaction, net of offering expenses payable by the Company.

Our mid-year update Entering infectious disease therapeutic area Executing on commercial

launch Expanding oncology platform beyond uveal melanoma Pioneering breakthrough discoveries in TCR therapeutics Projected financial runway through 20251 1. Projection based on the current business plan, includes projected

KIMMTRAK/tebentafusp net revenues. Immunocore may have based this estimate on assumptions that are incorrect and may end up using its resources sooner than anticipated, including as a result of increased costs or milestone payments that may

become due.

7 BRIAN DI DONATO Chief Financial Officer and Head of Strategy BAHIJA JALLAL, PhD Chief Executive

Officer DAVID BERMAN, MD, PhD Head of Research and Development Q&A Session RALPH TORBAY Head of Commercial

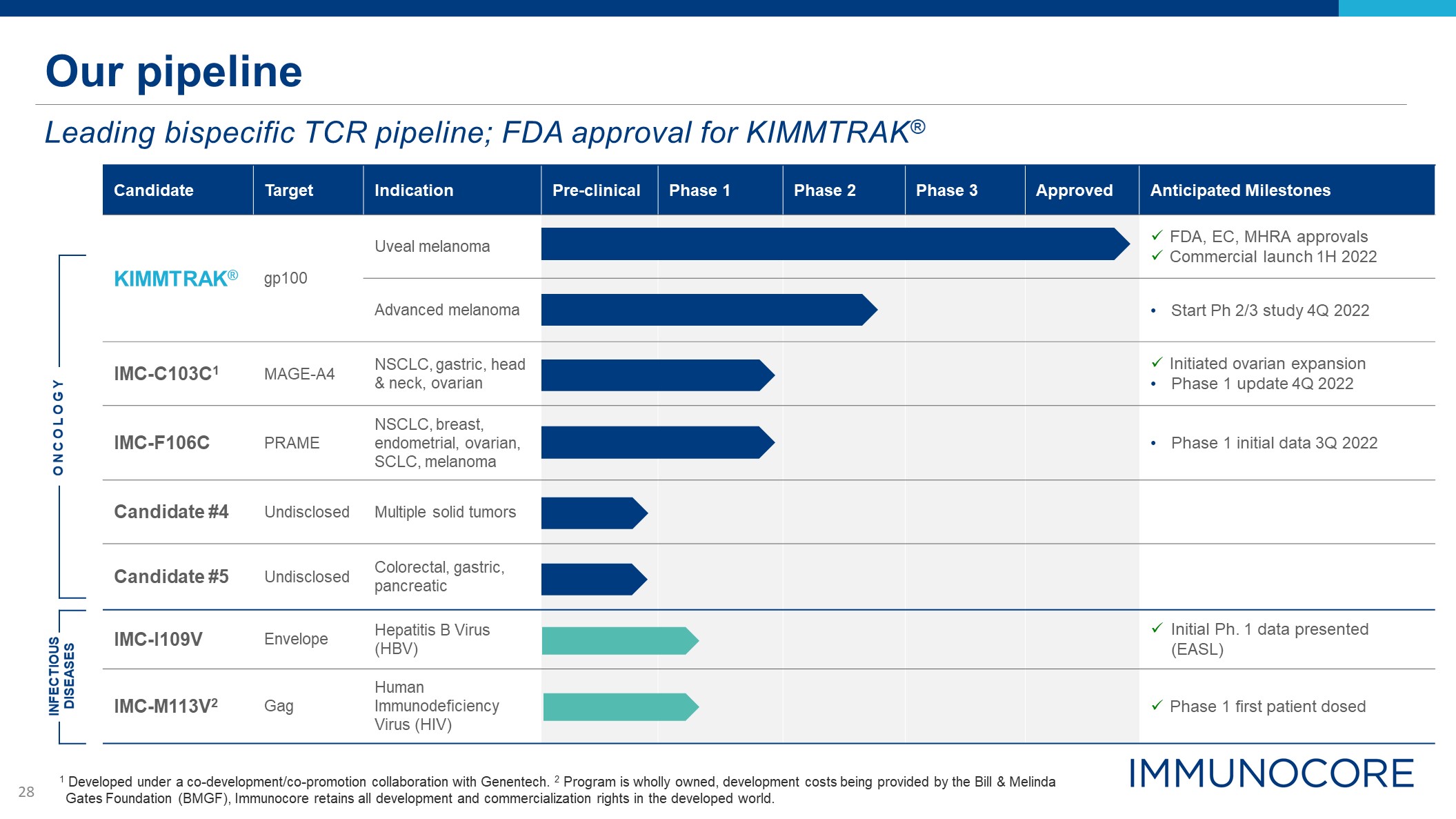

Our pipeline Leading bispecific TCR pipeline; FDA approval for KIMMTRAK® 1 Developed under a

co-development/co-promotion collaboration with Genentech. 2 Program is wholly owned, development costs being provided by the Bill & Melinda Gates Foundation (BMGF), Immunocore retains all development and commercialization rights in the

developed world. Candidate Target Indication Pre-clinical Phase 1 Phase 2 Phase 3 Approved Anticipated Milestones KIMMTRAK® gp100 Uveal melanoma FDA, EC, MHRA approvals Commercial launch 1H 2022 Advanced melanoma Start Ph 2/3

study 4Q 2022 IMC-C103C1 MAGE-A4 NSCLC, gastric, head & neck, ovarian Initiated ovarian expansion Phase 1 update 4Q 2022 IMC-F106C PRAME NSCLC, breast, endometrial, ovarian, SCLC, melanoma Phase 1 initial data 3Q 2022 Candidate

#4 Undisclosed Multiple solid tumors Candidate #5 Undisclosed Colorectal, gastric, pancreatic IMC-I109V Envelope Hepatitis B Virus (HBV) Initial Ph. 1 data presented (EASL) IMC-M113V2 Gag Human Immunodeficiency Virus (HIV) Phase

1 first patient dosed ONCOLOGY INFECTIOUS DISEASES